#Account now free

Besides being the best free Demat Account in the market, it has a simple interface that is very easy to use. With the 5paisa app, you can now open a free Demat Account from the comforts of your home. You may upload scanned copies of the documents with a few brokers to the account opening portal. Remember, you may select from various options as ID proof or address proof. There are governments who have already approved the documents you need for a Demat account.

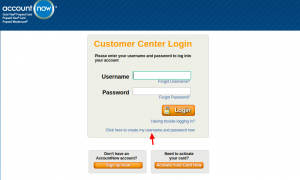

#Account now verification

Note: If bank verification fails, bank proof is mandatory to submit.Īs a shareholder or investor, you can hold shares electronically. Get the entire list of account opening documents with 5paisa. Income Proof (For derivatives & currency segment).If you want to opt for a Demat account, you need important documents.įor Individuals, documents required include: Later on, the data gets verified using the applicant's Aadhar card by 5paisa. They simply need to agree to the eKYC from the digital brokerages. Let's be frank – customers now get a chance to online Demat account open without undergoing any cumbersome filing process. In the digitalised landscape of this 21st century, the conventional process of submitting paper forms is time-consuming. Submit the required documents, verify your KYC.5paisa executives will contact you and guide you through the account opening process.Select the 'Open Demat Account' Option.

#Account now download

It also reduces risks associated with delayed settlement. There's no stamp duty paid on the shares' transfer. In these accounts, it is convenient and easy to hold securities. Besides, it eliminates risks with forgoing share certificates. One of the most significant benefits of these accounts is to help users refrain from problems associated with conventional share certificates. It also ensures that they can trade & invest in real-time virtually in their account. Its prime objective is to ensure investors do not require having physical shares. Then, they are stored in the Demat accounts. Shares are converted directly into digital format. Demat stands for dematerialisation since investors need to hold these shares & security on virtual platforms.

In short, dematerialisation is the process that converts the physical share certificates and transforms them into an electrical form. But today, the whole process made sharing trading difficult. So, are you planning to invest in the share market? If yes, it has now become mandatory to open online Demat accounts.īack then, shares used to be held in traditional forms through share certificates. Besides, it also mitigates challenges and risks one may experience with physical share certificates. In short, it is a tool that maximises your wealth & safekeeping Demat accounts simplify and accelerate share trading procedures. An online Demat account may be used to hold shares or stocks, mutual funds, government securities, ETFs, and bonds. A Demat account (short for Dematerialized account) is similar to a bank account – it is used to hold investments in an electronic form.

0 kommentar(er)

0 kommentar(er)